80+

Trade more than 80 currency pairs 24 hours a day, 5 days a week

EUR/USD

Low spreads with EUR/USD and no commissions

>10.05 ms

Average execution time is less than 10.05 ms

3500+

Up to 3500 orders are executed per second

DATA

Ultra-low latency from data centers

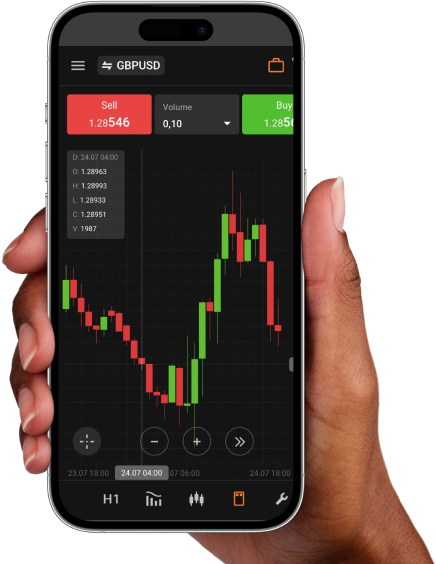

Online charts

Use the main tool of traders — technical analysis on the chart of a financial instrument

FAQs

What is Forex trading?

The Forex market, also known as the foreign exchange or FX, is a market where currencies are traded. It is the largest and most liquid financial market in the world, opened 24 hours a day, 5 days a week. In comparison, the New York Stock Exchange has a daily transaction volume of approximately $169 billion, while the Forex market’s daily turnover is an astonishing $5 trillion!

How does Forex work?

A CFD is a financial instrument that allows traders to invest in an asset class, namely currency pairs, without actually owning the underlying asset. CFDs offer traders the opportunity to profit from price movements — rising or falling. It is calculated as the movement of an asset between the entry and exit of a transaction, calculating only the price change without taking into account the underlying asset value. CFD on currency pairs works as a contract between two parties (buyer and seller). It states that the seller will pay the buyer the difference between the current value of the asset and its value when the contract expires. If the difference is negative, the buyer pays instead of the seller.

Who is involved in Forex trading?

There are several major players in the Forex market, including central banks, commercial banks and investment banks. This is called the interbank market because they are constantly interacting with each other on their own behalf or on behalf of their clients. However, there are other participants in the Forex market, which also include large multinational corporations, global money managers, registered dealers, international brokers, futures and options traders and individual investors.

How expensive is Forex trading?

That depends on how you want to trade, whether you use leverage, and how much capital you are willing to risk. You can start by investing $50 or $50,000 — there is no limit to the amount. However, you must remember that as your leverage increases, so does your risk. Ultimately, trading comes down to the player’s risk tolerance and risk management. Skilled traders can minimize risk and maximize profits through careful analysis, development of an effective trading strategy, and prudent money management.